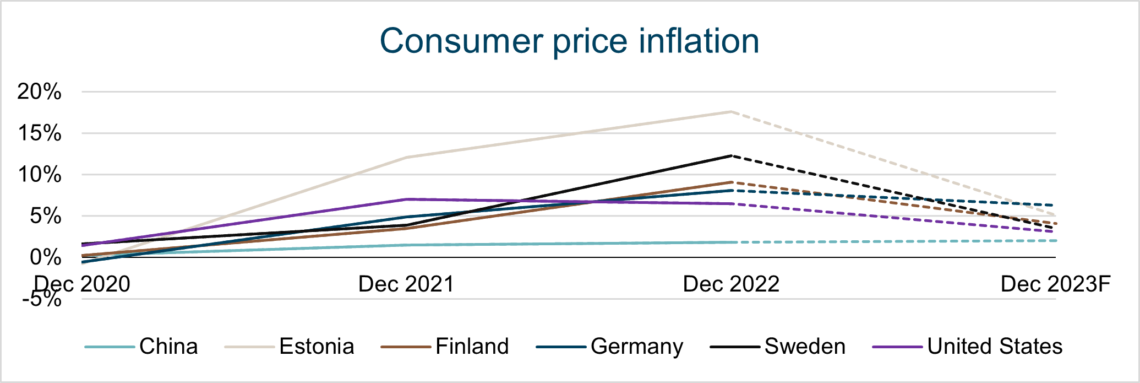

Last year, 2022, was characterized by an unexpected acceleration of inflation which forced central banks to respond and raise central bank interest rates.

Forecasts for 2023 are mainly expecting consumer price inflation (CPI) to cool down and prices still to rise but at a slower pace. In 2022 we did not see high wage increases, but there will be a delayed effect in 2023 as salary increases taking effect from 2023 onwards will be negotiated. Raw material prices, including metals, experienced dramatic price reactions in 2021 and 2022, but they seem to have subsided for now.

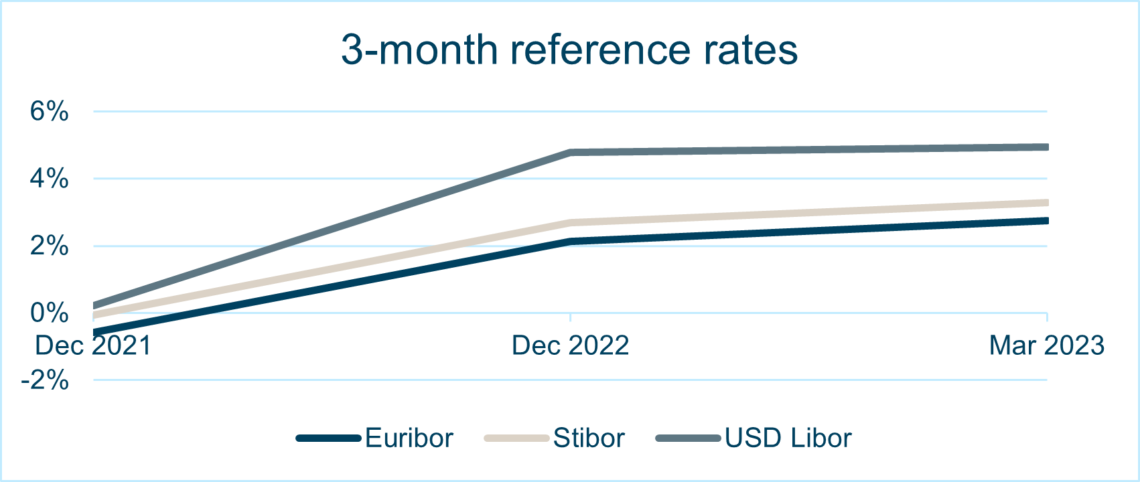

Interest rates in Western economies are on their highest levels since the beginning of the financial crisis in 2008. Market expectations regarding yield development in the US and Eurozone have been persistently pointing upwards. The recent development in the banking sector is casting some uncertainty on these views, but in absence of a severe escalation in the situation, yields are expected to remain higher than what we typically saw in the 2010s.

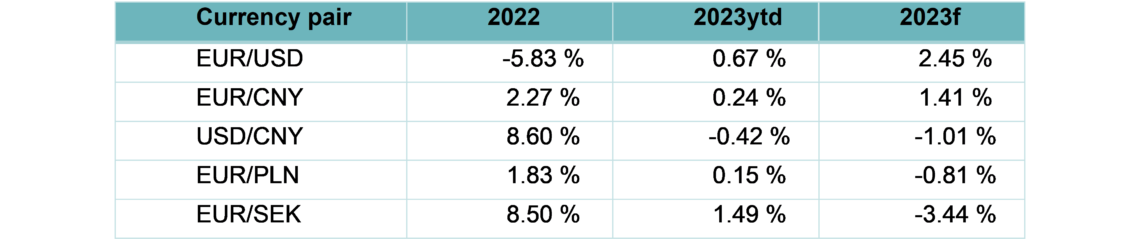

The foreign exchange market saw periods of elevated volatility in 2022 as rising interest rates and rapidly changing risk sentiment caused short-term swings. In general, safe-haven currencies strengthened whereas smaller currencies mostly weakened. The US dollar gained markedly, driven both by rising US rates and increased demand for safe-haven currencies. In September EUR/USD level of around 0.96 represented the strongest dollar against euro since the early 2000s. Towards the end of the year the situation became somewhat more balanced as rate hikes in Europe leveled the situation. This year changes in Scanfil’s key currency pairs have so far remained limited and are in general expected to move in a narrower range than last year.